介绍:

China approves 2 more private banks

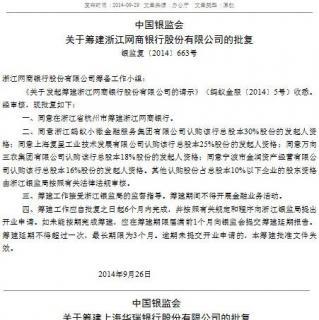

In its latest bid to promote private financial services for small businesses, China's financial regulator has approved another two private banks, with one in Shanghai and the other in neighboring Zhejiang Province.

One of them is co-funded by e-commerce giant Alibaba, holding 30-percent of the bank.

But the two new private banks don't have official English names yet.

The China Banking Regulatory Commission requires them to be established within 6 months from Monday.

Guo Tianyong is the director of the Center for Chinese Banking Studies at the Central University of Finance and Economics.

"They will bring the latest technology to the banking industry, which will greatly help the financing of micro-business. At the same time, it promotes the use of more updated technologies. I think it will be an example of survival of the fittest and upgrade the banking industry as a whole."

This follows a similar move in July, when the China Banking Regulatory Commission approved the establishment of three private banks, including Webank, funded by Chinese Internet giant Tencent.

Currently, China has only one private bank in service, China Minsheng Bank, which was founded in 1996 in Beijing.

Call-in with Mike 27 More Businesses Open to Foreign Investors in the Shanghai FTZ

The Shanghai Free Trade Zone is now just over a year old, with authorities commemorating the anniversary last week by expanding access to foreign investors.

27 different sectors are being opened up to wholly-owned foreign enterprises in the Zone.

Some of the areas include cargo management, shipping and others.

Since being launched just over a year ago, around 12-thousand companies are now operating out of the FTZ.

For more on the Shanghai FTZ, we're joined live on the line by Mike Bastin, Director of the China Business Centre at Southampton Solent University.

…

Back anchor:

Mike Bastin, Director of the China Business Centre at Southampton Solent University.

China revises Q2 current account surplus to $73 bln

China has revised its current account surplus for the second quarter to over 73 billion U.S. dollars from the former figure of 72 billion.

The country's foreign exchange regulator has also revised its capital and financial account deficit to some 16 billion U.S. dollars, down from an initial figure of 37 billion.

China to see the fifth consecutive drop in gas and diesel prices

China's market regulator has announced another drop in petrol and diesel prices, starting at midnight.

This is the fifth consecutive drop in fuel prices this year.

Experts predict the reduction comes before the week-long National holiday that may help boost tourism.

China looks to improve influences in world trade arbitration

China is looking to improve its influences in world trade arbitration, as the country becomes more engaged in world markets.

The China Council for the Promotion of International Trade, or CCPIT, has set up two arbitration courts in Beijing.

Yu Jianlong is the secretary-general of the CCPIT.

"The China International Economic and Trade Arbitration Commission and China Maritime Arbitration Commission decided to establish two arbitration courts. The purpose is to increase influence of China's arbitration around the world. It will also improve the competitiveness of the two commissions. They will also provide arbitration services of fairness, efficiency and convenience to international parties."

Rulings made by the courts will be recognized in more than 150 countries around the world.

Lufthansa pilots plan to strike on Tuesday

Lufthansa pilots will strike tomorrow after talks over an early retirement scheme broke down again.

It is predicted that 70 to 80 flights from Frankfurt will be affected.

Lufthansa has not commented yet.

The union for the pilots wants the company to maintain a scheme that allows pilots to retire early at 55 and still receive up to 60 percent of their pay before their regular pension starts.

Lufthansa has rejected the scheme, saying that increasing life expectancy allows people to work until they're 65.

Air France pilots have just called off a two-week strike that cost the airline more than 350 million U.S. dollars.

Lenovo says its $2 bln deal with IBM to close this Wednesday - updated

Lenovo will close its acquisition of one of IBM's server division this Wednesday for some 2 billion U.S. dollars.

The world's largest PC marker announced the decision at a press conference in Beijing.

Yang Yuanqing is the CEO and chairman of Lenovo Group.

"Lenovo will become the world's third largest server provider after the acquisition, and gain profits of about 5 billion U.S. dollars. The acquisition will be helpful to improve our technological development and overall capability in server field ."

With this move, Lenovo will also expand its offerings for business clients.

The group will get access to the server-business-related intellectual property of 1,100 patents and the patent applications.

But the purchase price is lower than the number announced earlier this year.

Lenovo explains that this is due to a change in the valuation of inventory and deferred revenue

liability.

Brussels to accuse Apple over illegal Irish tax deals

The European Commission is reportedly accusing Apple of benefitting from illicit state aid in Ireland.

The accusation is based on preliminary findings of an investigation into tax deals.

The company may face up to billions of euros in fines.

Preliminary investigations by the commission allegedly claim Apple benefited from illicit state aid after striking illegal deals with the Irish authorities.

The Irish government said in an earlier statement that it has not breached state aid rules.

A

大家还在听